Warby S-1: Post from August 2021

The grandaddy digitally native brand of them all files to go public

The IPO is coming soon. Can’t wait! In retrospect I was a little aggressive on valuation expectations in the post below. Perhaps it should be $4B. We’ll see!

1/ TLDR @warbyparker S-1: Soulful brand with a sharp price point (in a hard to enter industry) could be an iconic stock. Needs to show operating leverage, prove the next retail locations are as strong as prior ones and prove adjacencies to grow into what will be a hefty valuation

2/ @warbyparker more traditional retail rollout than other DNVBs. ~65% revenue from retail stores and US store count expected to more than 5x from here. Comparatively, @wearfigs is 100% online and fully online @schein has taken the fast fashion category lead over @hm @zara

3/ @warbyparker retail unit economics laid out here are quite compelling. Store payback of under 20 months (< 2 years is world class); sales per ft2 of $2,900 and four wall margin of 35%

4/ With 144 stores and an anticipated future U.S footprint of 900, much runway to grow. Let’s look at 2019 for store economics. With 119 stores in 2019, revenue per store was $2M. Likely a lot higher than that as stores are far from maturity and several opened during the year.

5/ Assume $2.5M in mature revenue a store, 600-700 more stores would be $1B+ in additional revenue, not counting associated digital lift in geographies with a store footprint. So @warbyparker more than doubles the business (and likely more) off of the US retail rollout alone

6/ As an aside, I wish someone would lay out in an S-1 how store openings impact the digital business and present a more holistic view of the store economics, inclusive of surrounding geographic lift. But… once again, we do not see that here

7/ The retail rollout and associated digital lift has led to strong growth for @warbyparker. After an explainable COVID hit (~+6% YoY growth in 2020), growth accelerated to + 53% in 1H 2021. Growth was 36% YoY in 2019

8/ Looking at the market top down, with 200M US adults using vision correction and 2 million customers, @warbyparker has penetrated 1% of the market. Vertically integrating into vision telehealth is a big potential unlock. So is international and contacts. Lots of runway here

9/ As exciting as the market and top line opportunity are, the @warbyparker story has some holes and areas for big improvements, starting with retention

10/ Retention is mediocre, with 98% Sales Retention Rate over 48 months, 50% over 24 months. In English, this means, of the customers who purchase initially, if they spend $100 on 1st purchase, they’ll spend an additional $50 over the next 2 years and $98 over the next 4 years.

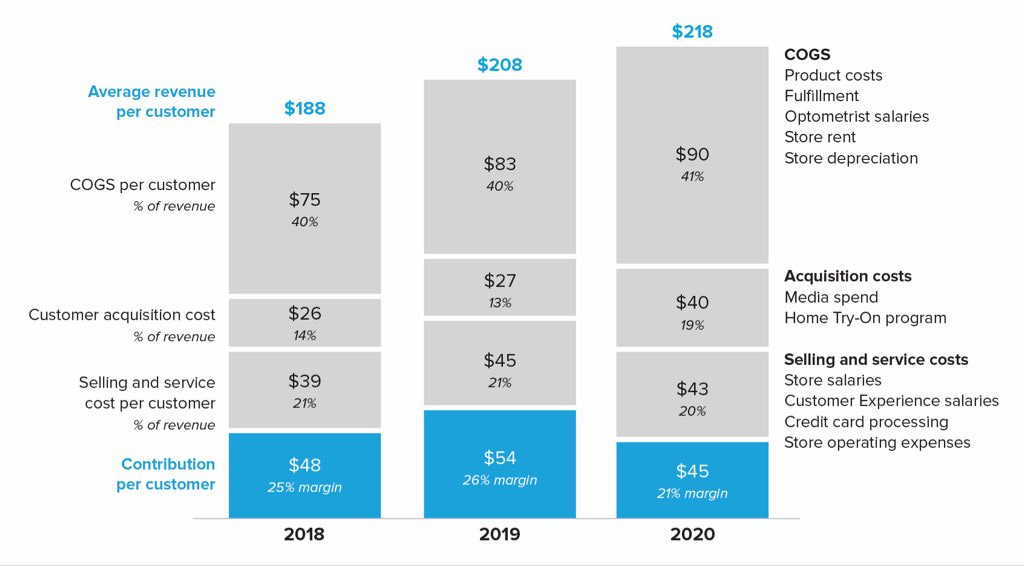

11/ While @warbyparker retention is clearly better than mattresses, it compares unfavorably to other retail businesses like @nike @lulu, where customers often purchase 3-5 times a year.

12/ Warby said years ago that cheaper glasses will lead customers to buy more frequently as a fashion statement. Is this happening? How dispersed is retention - what % of customers buy a second time and how active are the most active customers? They don’t give that detail

13/ The company is not yet showing operating leverage. Increase in revenue per customer is offset by increased acquisition costs. I wish they broke out the new store expenses from the P&L so we could see the operating leverage on the mature stores and e-commerce business

14/ What is the mature operating margin of this business? Looking at the 26% contribution margin they saw in 2019 and assuming they can drive overhead G&A to 12-15%, this feels like a mid-teens EBITDA margin business at best.

15/ @warbyparker is not transparent in giving us new customer CAC- defining CAC as acquisition costs for a given period divided by number of Active Customers during that period. Who does that - I have never seen it defined that way across hundreds of e-commerce Board decks!!!

16/ Right now we see they are profitable on each purchase - with an AOV of $218 and a 40% contribution margin (not including marketing). But this blends new and existing customers - my gut is they spend up to contribution margin to acquire new customers but we can’t verify that

17/ Best comp for Warby is FIGS, which trades at ~11x 2022 revenue and 21x 2022 gross margin with similar growth expectations of 33%. FIGS spits out a lot of cash and will have a much higher mature EBITDA margin but has a much lower TAM

18/ CHEWY is another good comp - trading at 13x 2022 gross margin but losing a lot of money

19/ Assume Warby grows 40% in 2H 2021 —> $574M in 2021 revenue. Assume +30% YoY —> $745M in 2022 at 60% gross margin. My gut is Warby trades at ~15x gross margin —> market cap approaching $7 billion. Could be higher if I undershot growth estimates or just based on high TAM

20 Separately, fascinating to see social mission play a huge role in the story. Has given away >8M glasses to people in need. Trying to reconcile @warby social mission story with @schein_official. Sustainability and mission matter to millennials unless product is really cheap?

21/ 21/ Finally, @maveron we have gone against the grain in believing venture returns are going to happen in digitally native brands. With @wearfigs and @warbyparker, it is great to see that become a reality. Excited for @warbyparker to ring the bell!