Turo S-1

COVID turned this car rental marketplace into what can be the next shared economy behemoth

1/ For my first S-1 teardown of 2022, let’s dive into rental cars and @Turo. TLDR: With supply chain problems leading to a lack of rental car supply, Turo, the world’s largest car sharing marketplace, has soared by offering both breadth of supply and value to consumers. Is this temporal or are they building a long-term iconic brand?

2/ With tepid 6% top-line growth, $150M in sales and almost $100M in losses in 2020, @Turo looked like it was destined to fail. It was the same reason we turned down the company in 2016 (then known as RelayRides). There was not a clear “why now” narrative.

3/ Then COVID happened and that why now question was answered in spades. @Turo barnstormed through 2021. For the nine months ended September 30, 2021, net revenue grew 207% to $330.5 million, from $107.8 million in 2020!

4/ Before digging into the numbers more, let’s do a search on both @Turo and @kayak. @Turo is as much as 43% cheaper for a small SUV in Honolulu for March 17-23. You’ll pay $231 for a Subaru Forrester @Turo delivered to the airport vs. $406 for a Buick Encore from @Dollar.

5/ Before COVID, when I could rent from @enterprise at $30 a day, I never would’ve rented someone else’s car. But with traditional car rental prices in many cases approaching $100 a day, customers start shopping. And a good @Turo experience at a price >40% lower will lead to long-term loyalty.

6/ @airbnb @uber @lyft have conditioned people to find renting someone else’s car to be completely ordinary. I’d posit that this behavior change is sustainable and once customers try @Turo they aren’t going back to @hertz. But let’s dig into the data.

7/ @Turo has 161K active vehicles, 1,300+ makes and models, and is in 7,500+ cities. Its 85K car owners (hosts) serve 1.3M guests (customers). Guests booked 7.4 million days on @Turo over the nine months ended September 30, 2021. That is $44.66 per day.

8/ @Turo has huge business model advantages over legacy competitors. They are asset-free and do not have to access huge pools of debt capital to lease vehicles. They are not subject to global supply chain, labor shortages or the rapidly rising prices of cars and labor. @Turo can let the marketplace be the master, and both pricing and supply can fluctuate based on macro factors.

9/ In a gig economy, people are looking for ways to monetize everything, and the host value prop here is strong. Why not lease out your car when you are out of town or when you don’t plan to drive for a few days? This is easy income and a way to monetize an underutilized asset (your car).

10/ On the customer side, once you get over the mental hurdle of renting from a regular car owner, you not only save time, but you have a more customer-centric experience. The car is brought to you and you don’t have to wait in line at a rental counter only to be upsold unneeded products. @Turo has NPS of 70 compared to 9 for Avis and -3 for Hertz.

11/ The high NPS manifests itself in strong word-of-mouth referral and repeat. For the 12 months ended September 30, 2021, 87% of site traffic was organic and approximately 43% of rental days were generated from repeat guests.

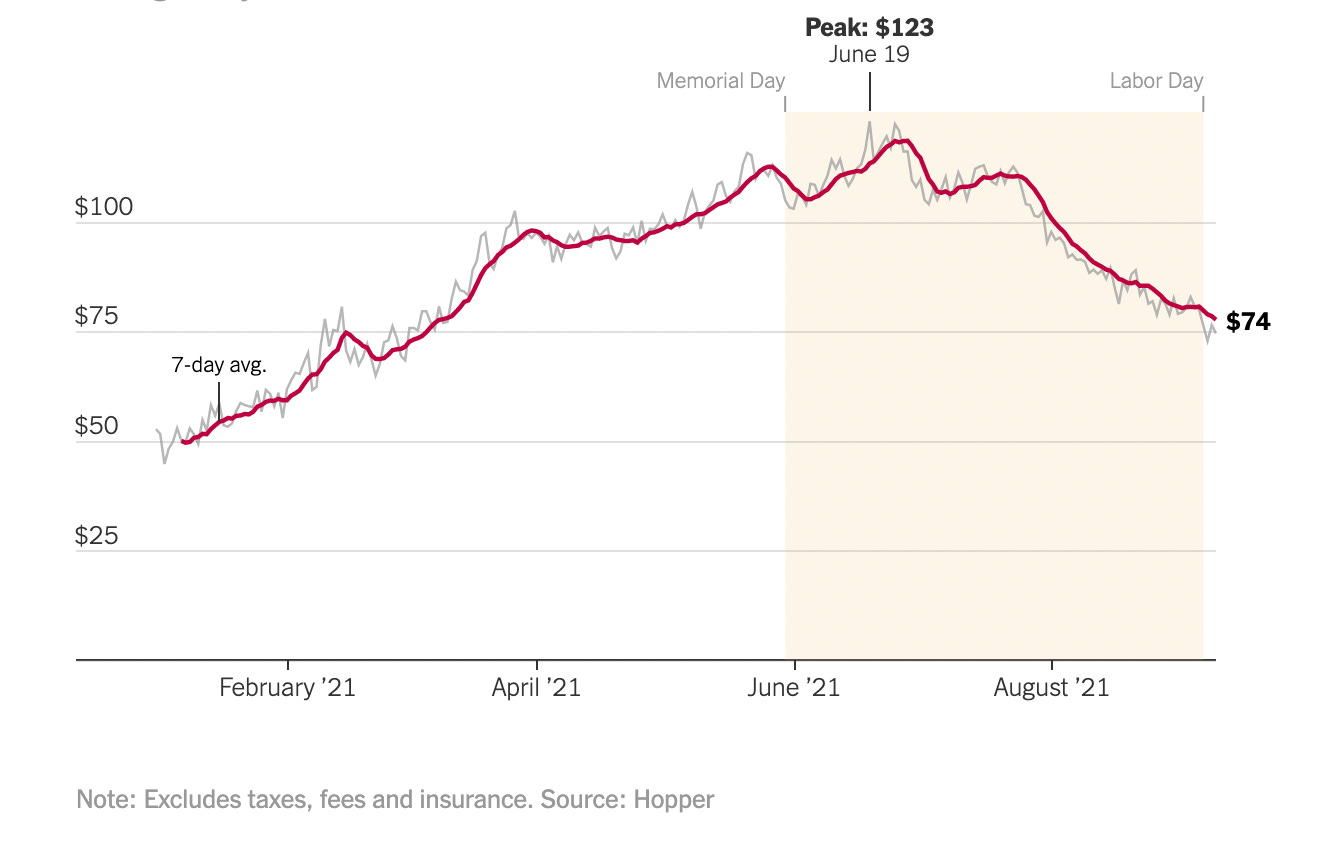

12/ So how big is the opportunity? The most narrow way to look at the market is by only using the domestic car rental industry. This was $28B in 2021, up from $21B in 2020. https://www.autorentalnews.com/10157505/2021-u-s-car-rental-revenue-climbs-21-year-over-

13/ The car rental industry shrunk significantly during COVID and is having trouble scaling back up. In Q2 ’21, the size of the combined Hertz and Avis fleet was 312,000 cars smaller than in the second quarter of 2019 (down 30%!). https://www.nytimes.com/2021/09/20/upshot/car-rental-prices-economy.html

14/ With demand up and car fleets undersized, rental car prices have gone through the roof, creating the market opening for @Turo.

15/ @Turo claims its market isn’t just car rental but mobility more broadly. Why buy a car when you can just rent @Turo? To reach $10B in value, @Turo needs to relentlessly execute on its core business. This broader opportunity can be act two (or maybe act three - international makes sense next).

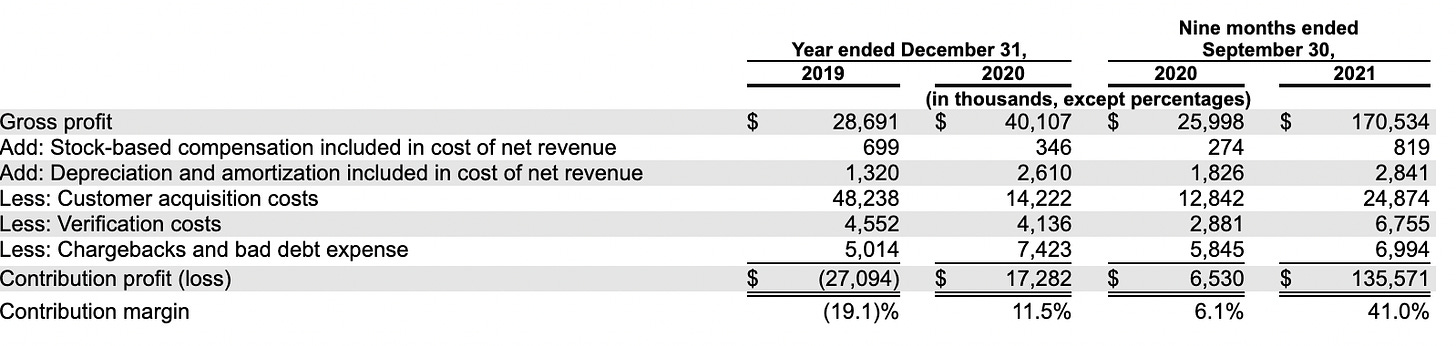

16/ @Turo has a great “why now story” and a clear customer value proposition, but also displays strong unit economics. For the nine months ending Sept 30, ’21, the company generated $46.5M in operating income. Gross margin rose from 24.1% to 51.6%. G&A as a % of net revenue fell from 38% to 22% . Sales and marketing fell from 16% to 6.4% of net revenue.

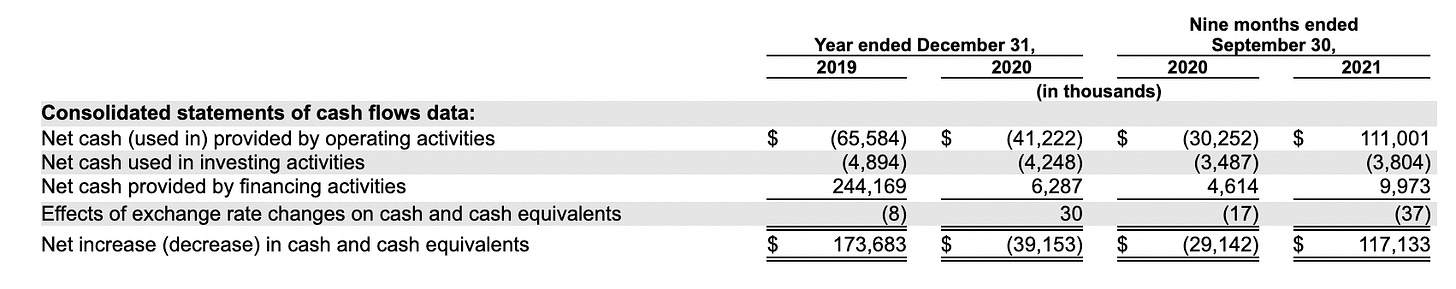

17/ The contribution margin of @Turo rose to 41% in the 1st nine months of ’21, from 6% in the year prior. Clearly, this business has strong earnings power in this current macro environment.

18/ @Turo has even better cash flow characteristics. They take payment at the time of a booking and recognize it when the car is rented. As such the company generated $111M in operating cash flow in the first 9 months of 2021, despite only $46.5M in operating income.

19/ So the operative question is whether the economic boom for @Turo is real or, like Instacart’s big spike, is a short-term function of COVID. It feels like supply/host acquisition will not be a barrier to growth, so let’s look at the demand side.

20/ One way to assess the durability of @Turo is to look at customer cohort retention. What they show us is worthless as it’s annual with the latest cohort data from 2018. There would be real signal in quarterly cohorts from 2020 and 2021, which they sadly do not show.

21/ Another thing to look at is @Turo marketing expenses. Marketing was 10.9% of net revenue in Q3 ’21, compared to 8.8% in Q2 and 6% in Q1. Spending is higher on a percentage basis but the company grew 257% from Q4 ’20 to Q3 ’21. With 41% contribution margins, you can easily absorb that spend.

22/ Clearly the profitable growth of @Turo will attract competition. Existing car rental companies will eventually have more cars available as supply chain issues are worked through. Folks like Uber or Lyft could offer a competitive service to their drivers or customers. But @Turo has the ability to secure market leadership.

23/ So what is @Turo worth? The best comparable here is @airbnb. Airbnb has significantly higher gross margins so let’s use a gross margin multiple. I do not have forward projections here and the market is so unpredictable so let’s just use a multiple of trailing twelve month gross margin.

24/ The trailing twelve month enterprise value / gross margin multiple for @airbnb is 16.4x. That would equate to a market valuation of ~$3 billion for @Turo. The (multi-) billion dollar question is how long this period of hyper-growth will endure.

25/ I come away from this exercise a big believer in @Turo. It has a strong sustainability and ESG story as it enables high utilization of idle assets and extra income to hosts. It also offers a more affordable and personal experience to consumers. I’m excited for @Turo to ring the bell!

Another excellent post by Jason... Turo has also some appeal as a "cool alternative" to Uber/Lyft and certainly to mainstream rental car companies; almost like Apple was a cooler alternative to IBM PCs back in the day...Naturally as Turo grow, that "coolness" will cool -- pardon the intentional pun.

If Turo was growing 6% before Covid, why do you expect growth to be high post covid?