Remitly S-1

Disrupting Western Union seemed a tall mountain to climb... and then Remitly did it

1/ TLDR @remitly S-1: Disruptor of @westernunion makes remittances cheaper + faster + easier +digital. Anti-portfolio for me - I met founders @mattoppenheimer @joshhug in 2012. I turned down as I found the degree of difficulty too high - @remitly needed to get money transfer licenses in every state + learn how to operate and create demand internationally.

2/ Remitly has proven me wrong and brilliantly delivered on their vision. Customers no longer need to wait in line @westernunion and pay obnoxiously high fees. Remitly has high marketing spend but big TAM, strong retention and increased operating leverage point to a bright future.

3/ Huge market - 280 million+ global immigrants send $1.5 trillion in global remittances. This generates $40 billion in annual transaction fees, of which Remitly has 1% share

4/ Before digital first competitors like @remitly @transferwise @xoom, customer had to wait in line @westernunion @moneygram. Now >85% of consumers engage with Remitly on mobile phones and >75% of transfers complete within an hour

5/ @remitly is very focused on immigrants and their families. This contrasts with broader product offerings, including B2B at competitors like @wise.

6/ Focus is on a broad set of receive options: bank transfers, debit cards, credit cards, home delivery, or pickup. @remitly has ability to deliver to billions of bank accounts globally and 355K cash pickup locations.

7/ Not only is @remitly more convenient and faster, it’s a superior business model to legacy companies. It has greatly reduced systemic cost with no local brick and mortar operations or even employees in local markets.

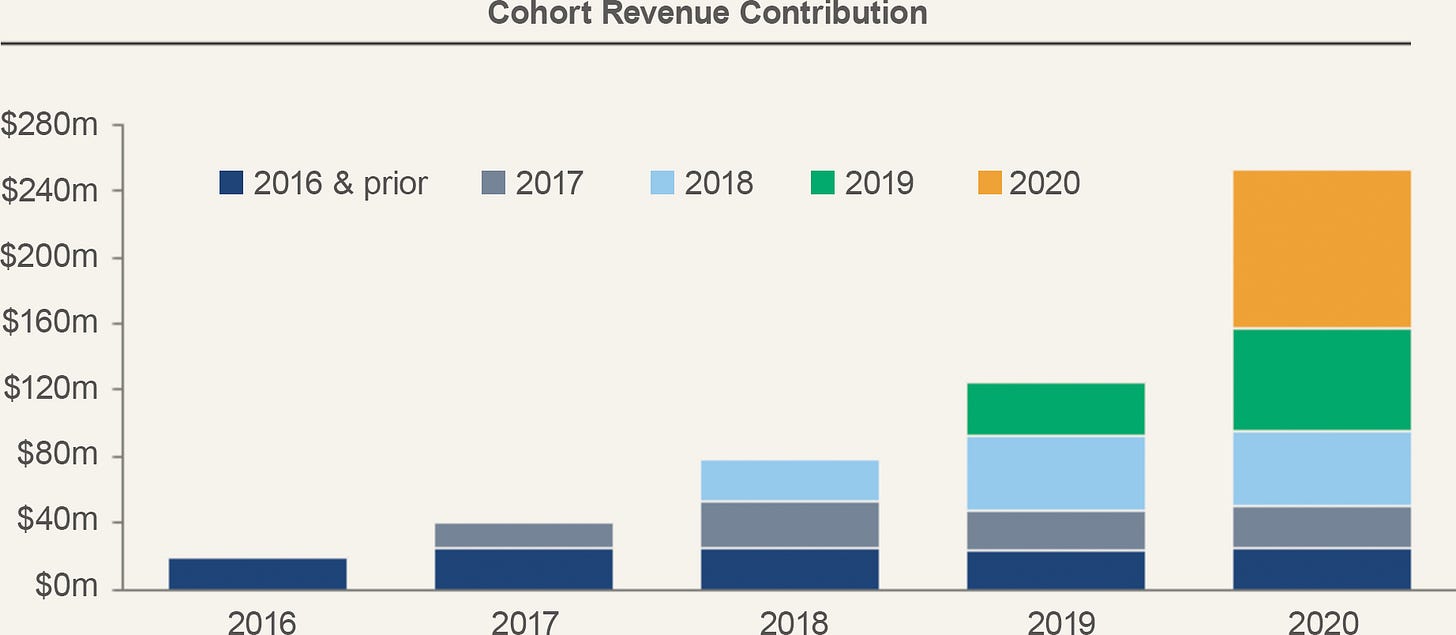

8/ Unit economics appear strong. Payback in 10 months. LTV/CAC > 6x over 5 years.

9/ Really nice revenue retention of >90% in the out years

10/ Phenomenal growth paired with a march toward profitability. H1 2021 revenue of $202.1 million (+92% YoY). There was a COVID bump here and active customer growth did slow to 57% in Q2, but still very heady. Operating loss down from -17.7% to -5.2% YoY. Marketing as % of revenue down from 30.5% to 25.9%

11/ @remitly also generating a higher take rate as volume ramps - with net revenue 2.12% of send volume in 2020 vs 1.78% in 2019. How will this trend over time - will network effects and dominant market share in certain corridors enable more pricing power or increased competition eat away at it?

12/ If trends continue, feels like a mature operating margin of high teens up to 20% is realistic by 2025

13// @remitly, along with competitors like @paypal (Xoom) and @wise, are methodically stealing share from Western Union, whose revenue has fallen from $5.6B in 2018 to $4.8B in 2020.

14/ That said, there is a big regulatory moat here for new entrants. These include getting money transmitter licensees in every US state; int’l regulatory approvals, big networks of banks and retail locations to accept remittances. It sets up well for years of continued growth for @remitly.

15/ Bulk of @remitly revenue is US- based with biggest receive countries India, the Philippines, and Mexico. I wish they disclosed market share by receive country - would be helpful to understand if there are local network effects in generating demand and who is #1 competitor in each country

16/ Close competitor Wise did $421M for the year ended March 31. It has much lower growth than Remitly (+43% YoY in Q1) but is profitable with an 11.1% operating margin. Assume @remitly growth slows to 50% for the remainder of this year —> ~$430M in 2020 revenue. Assume 40% next year —> ~$600M.

17/ How will investors value growth vs profitability? In this market, growth usually wins. Wise is trading at a very heady market cap > $10B. Remitly has a chance to reach something close to this valuation

18/ Note these stratospheric valuations are hard to stomach. @westernunion valued at ~$9 billion with $5B in revenue and ~$1B in operating profit. The market is betting on great execution for years to come to justify the valuations out there in this space

19/ Potential upside for @remitly: (a) Adding more markets - they have less than half the send countries as Wise; (b) Cross sell new financial products. Passbook, their neobank partnership, proves customers are willing to buy other @remitly financial services, starting with deposits

20/ I always lose sleep over my anti-portfolio, but a shout out here to @mattoppenheminer @joshhug and the whole @remitly team for building a business that is saving money and time for millions of immigrants and their families. I expect @remitly to leverage continued global remittances growth and share shift from incumbents to generate heady growth for years to come

Thanks a lot for sharing.

1- Can you please share how Remitly sends money, does money move across borders unlike wise? How they actually send money abroad, using same correspondent old banking system or they have developed their own infrastructure?

2- Their take rate is 2% even for digital transfer vs wise of 0.7% and overtime, cash pickup and other Remitly solutions would move digital as well. In 2060, more money would move digitally than cash, then how come they earn money from dying engine?

your guidance would be appreciated.