1/ Reddit is a social network that represents the nerd in all of us, and where millennials in particular geek out on niche interests. Our team at work avidly follows /r/SubtleCurryTraits, /r/oldschoolcool, /r/taiwan, r/watches, r/LoveIsBlindOnNetflix, /r/AsianParentStories, /r/HubermanLab and more.

2/ The key to the Reddit IPO is threefold: (i) can they hyper-charge what has been moribund daily user growth; (ii) can they build an ad platform that accelerates revenue per user and (iii) how much can they increase data sales to train LLM models over time?

3/ After being founded in 2006, Reddit surged during COVID, more than doubling from 330M MAUs in 2018 to 766M MAUs in 2021. It came out of COVID strong, but the user growth has largely not continued.

4/ That said, Reddit has never been particularly focused on building a business. It feels bloated - with an inexplainable number of engineers for a business where users incessantly complain about the mobile app and where the website hasn’t seemed to have changed in a decade (R&D is $438M a year or 54% of revenue).

5/ Reddit has also monetized poorly. Despite a user base with very targeted interests, I have never seen Reddit mentioned as a significant recipient of paid advertising across Maveron’s broad portfolio of consumer companies. Their ad revenue is $3.42 per user per quarter internationally and $5.51 in the US, which has stayed within a bounded range since Q4 ‘21 and has not improved. This is ~4x lower than Facebook globally and ~12x lower in the US. It is close to Snapchat, which is at $3.29.

6/ Reddit’s corporate mission likely works against them in building a business. Its S-1 explicitly states that Reddit “it is a privacy-first platform, unlike other social networks that tracks user activity all over the web or mobile apps. The foundation of our ad performance is based on context and interest instead of tracking users based on personally identifiable information.”

7/ Although users can’t be targeted for ads, Reddit’s data on niche topic areas turns out to be worth its weight in gold in training LLMs. In January 2024, Reddit entered into data licensing arrangements with Google and others, representing an aggregate contract value of $203 million and terms ranging from two to three years. They expect a minimum of $66.4 million of revenue in 2024. You have to imagine this number only goes up with time.

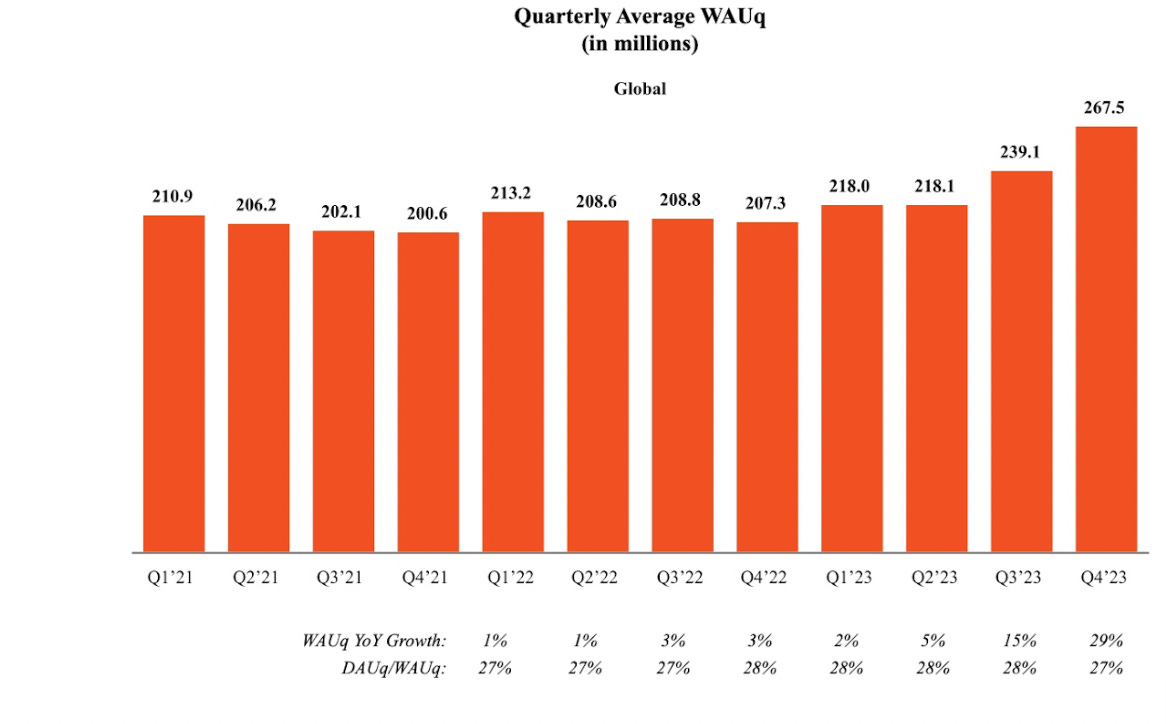

8/ Now let’s pivot to what will be required for Reddit to achieve its potential as a public company. The first tenet is whether Reddit can sustain its COVID-era user growth. The following chart shows Reddit user growth as being largely flat from 2021 until Q2 2023 before exploding the past two quarters. Reddit said “The post-pandemic period presented challenges such as lower user growth and declining engagement in 2022 and the first half of 2023.”

9/ So what caused the explosion in growth in 2H 2023. There are two plausible explanations: Most likely is the fact that Reddit killed 3rd party apps and API access eight months ago, right before usage increased. Note that users of 3rd party apps like Apollo and Boost were forced to move to Reddit. Apollo users were less than pleased. One wrote, “Currently 1st time on real Reddit. This app is garbage, the way subs are oriented makes no sense.” Or “just wait until you try watching videos. this app truly is a POS compared to what they killed.”

10/ The second potential cause of Reddit’s 2H 2023 growth is using AI to drive onboarding and retention. Reddit said that “we re-trained our New Home Feed ranking with significantly more data and user signals. For example, in the three months ended June 30, 2023, Reddit observed an increase of over 30% in “Good Visits,” defined as a user consuming a post for more than 30 seconds.

11/ For me, I am skeptical of Reddit’s user growth prospects - they’ll need to show me, rather than tell me. I have a sneaky suspicion that the recent user growth is people migrating from 3rd party apps onto the platform.

12/ Next let’s look at the growth potential of Reddit’s ARPU. Let’s look at Snap and Pinterest as comparables. On an annualized basis, Pinterest and Snap have grown ARPU 12% and 15% respectively per year since their IPOs. For both, they had a big pop in ARPU in the two years following their IPO. But, they also saw a COVID bump, in green, and have been unable to grow ARPU since 2021.

13/ For Reddit, there is clearly low hanging fruit - e.g. there is no pre-roll and mid-roll ads on Reddit today. But the company faces post-COVID advertising headwinds and real questions around whether they can they build an efficacious ad platform that enables advertisers to reach who they want to reach.

14/ You have to assume Reddit has some obvious ARPU growth built into their projections post-IPO. So maybe we can assume 12-15% a year for the next 3 years before flattening.

15/ The final area to examine for Reddit is the monetization potential of selling Reddit data to producers of LLMs such as OpenAI, Anthropic, Meta, Cohere and others. This revenue is pure cash flow and the question becomes how high can this revenue stream go - it is 10% of revenue today and, while it is clear this is nowhere close to its ceiling, it’s hard to project whether this becomes 15% of sales or 50% going forward.

16/ Now let’s look at their income statement. It has negative net cash flow from operating activities of >$74M. It feels like data sales to LLM providers alone should be able to drive this business to cash flow positive. That said, Reddit will have to prove that the $438M per year investment they are making in R&D will bear fruit, in order to justify that level of spend.

17/ So how is Reddit valued? I do not plan to build a model here. The lazy side of me could just look at

Pinterest (growing MAUs by 10.6% YoY, revenue by ~12% YoY and with an EV/revenue (ttm) of 7.3x) or at

Snap (growing users 10% YoY, revenue 4.7% YoY and with an EV/revenue of 4.1x).

18/ You could say Reddit has fully baked 18-24 months of user and ARPU growth into their IPO model. You could also argue that, like with Pinterest, Reddit has targeted and niche user data that is very valuable. So if you just comp’d it to Pinterest, at 7.3x, that would be a valuation of ~$5.9 billion. That is within spitting distance of the $6.5B number being reported in the press.

19/ I don’t know how you can make an informed bet on Reddit based on what is in the filing. You would have to have inside knowledge of the capability of this management team to grow users and/or their ability to build a robust ad platform and monetize it. Or you would need to have inside knowledge of the growth in the data sales opportunity to LLMs in coming years.

20/ Reddit’s reported $203M in revenue from LLMs over the next 2-3 years equates to $80M a year. If this turns into $400M a year, at a discount rate of, say, 10%, that is single digit billions of equity value. If it grows only modestly, Reddit is far less valuable.

21/ Especially at the rich reported IPO valuation, Reddit feels like it’s worth sitting on the sidelines. Let them prove in subsequent quarters that their recent user growth is real, that they can get those users to monetize and that they can extract more dollars from LLMs over time.

22/ I’ll leave you with the biggest wild card of all here - the Reddit community itself. If there is definitionally a potential meme stock where retail investors can cause mayhem, it’s this one. Look at the current sentiment on r/wallstreetbets - it looks like there are far more folks talking about shorting than buying on there.