1/ Mark Twain famously said, “I didn't have time to write a short letter, so I wrote a long one instead.” Despite its lack of brevity, the 313-page Instacart S-1 tells me very little of what I truly want to know. What I see is a business with a flat customer base and order counts, declining cohort purchase behavior and the opportunity to drive accretive value largely via advertising and operational efficiency.

2/ Given how overly covered this IPO filing is (not to mention dealing with a poor kid with an ACL tear at home), rather than doing a comprehensive teardown, I will raise a list of observations and questions that came to the forefront for me.

3/ The business is similar in some ways to Costco. There are 5.1M Instacart+ members. They pay on average $99 a year, if they pay list price. Assume it is an average of $80 per year after discounts. That is the equivalent of >$400M a year in free cash flow. The business generated $279M in adj. EBITDA and $242M in operating cash flow in 1H 2023, so almost all the profit is memberships.

4/ The Company positions itself as a technology company - with the goal to “build the technology that powers every grocery transaction.” It’s interesting, because Instacart looks more like e-commerce to me. You acquire customers and sell them stuff. I assume they want a multiple higher than an e-commerce or retail business might justify.

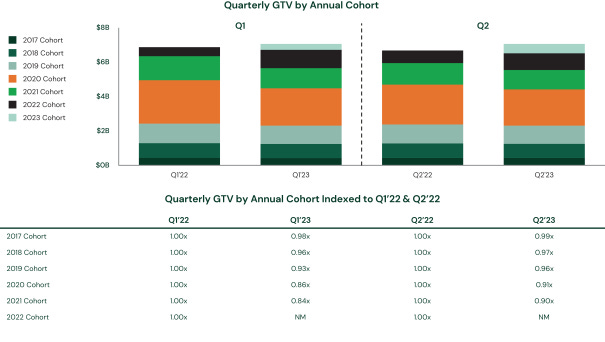

5/ Instacart saw a huge wave of free customer acquisition during COVID. The challenge is that, since COVID, these users are spending less or leaving. The following chart shows YoY drop-off in spend. 2021 acquisition cohort members who spent a certain amount in Q1’ 22 spent only 84% of that amount in Q1’ 23.

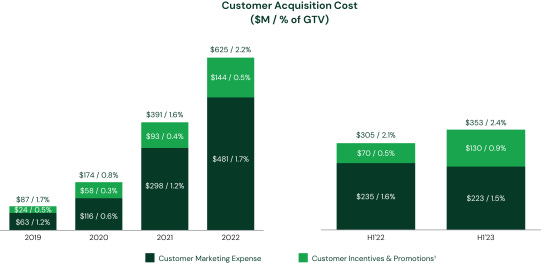

6/ So customers climbed onto a treadmill during COVID and now they are falling off the back. Instacart needs to replace them and they are doing so by spending a run rate of $700M a year in acquisition costs to keep order volume flat!

7/ What we do not see in the filing is any mention of how much it costs to acquire a customer and how customer economics have changed over time - what is LTV/CAC? what is a payback period? We have no idea! How can you value this stock without knowing these things?

8/ We will get to the underlying economics later, but my big question here is, without another pandemic happening, how can they actually grow customer count? You have already high brand awareness, inflation headwinds, and a pricy service in a price-sensitive grocery market. Adding customers to the core business feels like a very tall order - and each dollar you spend on marketing at the margin will yield less ROI.

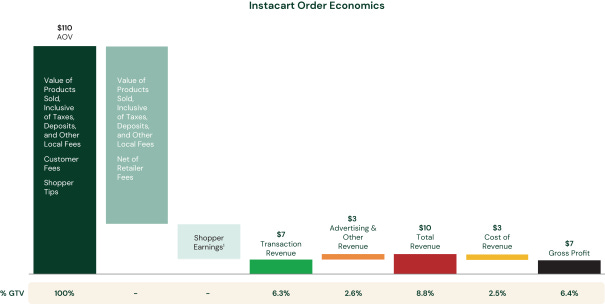

9/ On a positive note, Instacart is a case study in incrementally improving every efficiency metric, quarter-over-quarter. Instacart’s transaction revenue (6.3% of GTV) is their take rate from grocery partners (14.9% of GTV) minus shopper labor costs (8.2%). They make $3 on advertising per order, driving total revenue to 8.8% of GTV in 2022. This moved up to 9.9% in 1H 2023. Note it was 7.1% in 2020.

10/ On a gross profit standpoint (which nets out credit card processing, insurance and logistics from revenue), gross profit was 6.4% of revenue in 2022, up from 4.2% in 2020. It grew to 7.4% in 1H 2023.

11/ When you look at opex, the company has reduced opex (minus sales & marketing) to 34.8% of revenue in 1H 2023 from >50% in 2021. That is hard to do - this company is very good operationally in what is an extraordinarily complex business.

12/ So when we take a step back - what do we have? We have a company that turned online grocery into a huge category during COVID. Growth has tailed off, new customer acquisition is difficult and orders are flat. But via advertising and operational improvements, they have grown revenue 31% in 1H 2023.

13/ There is only so much juice you can squeeze from the onion in a margin constrained category, so huge jumps in operational efficiency are bound to tail off. A big question mark is how big the ad business can get - Pepsico’s agreement to buy Instacart stock ahead of the IPO is a validator of this part of the business. That said, with a flat customer count, you can only increase advertising so far.

14/ Instacart reportedly prices its IPO as early as Monday. The last 409(a) valuation is apparently $12B for a business doing roughly $560M in run rate annual adj EBITDA. Given its customer growth challenges and the opaqueness of this S1 filing, I’m certainly not a buyer at anything near the >21x adj EBITDA a $12B valuation would imply.

Thanks Simon!

Enjoyed reading this Jason. Thanks. Hope the ACL tear heals quickly.