1/ @Chobani S-1 TLDR: @chobani epitomizes a values-driven company and category leadership. But growth was glacial…that is, until oat milk came along.

2/ I still remember trying @chobani right after they launched in 2007. It felt so much healthier than the sugary strawberry and vanilla yogurts from @danone. And it tasted great (and still does).

3/ @chobani had a meteoric rise, putting most tech companies to shame. Only six years after the first cups of Chobani hit the shelves in New York in 2007, Chobani generated approximately $1.1 billion in net sales in 2013.

4/ @chobani redefines everything a mission-driven company can be. Their products are made in the US, with a manufacturing workforce that is 30% refugees and immigrants. It has sustainability goals in line with UN Sustainable Development Goals around emissions & water use.

5/ The same institutional pools of ESG capital and retail investors that salivated over @warbyparker @sweetgreens will be banging down the doors for @chobani.

6/ All that said, @chobani had a little problem from 2013-2020. They had category leadership but were trapped trying to innovate in a low-growth category. Sales rose from $1.1B in 2013 to $1.4B in 2020. Top-line growth was an anemic 3.2% in 2019.

7/ The business generated $105M in operating cash last year, but it is capital intensive and has spent an average of $74M in CapEx the past three years. So why is a low-growth business spending all that money? To innovate, baby.

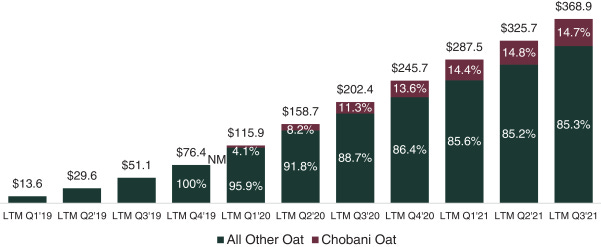

8/ To understand how those capital investments paid off, let’s flash back to 2019. @oatly is a new entrant in plant-based milk, having the same type of meteoric rise @chobani did a decade prior. @oatly scaled to $204M in revenue in 2019. It went public in May and is worth ~$6B today.

9/ Now remember all those investments in innovation, manufacturing and supply chain capabilities? They enable Chobani oat milk to go from idea to commercial availability in less than 12 months and hit stores in Jan 2020.

10/ The Chobani oat milk platform became #3 in the category after less than six months on the shelf and is now neck and neck with @LoveMySilk for #2 in the market, with 15.1% market share.

11/ Plant-based dairy as a category is growing, with $2.4B in revenue (+7.5% YoY). And the oat milk market is downright exploding. In the 52 weeks ended 10/16/21, it was a $376M category (+79.6% YoY). Oat milk rose from 10.7% to 17.6% of the plant-based dairy market in that period.

12/ @chobani didn’t innovate for years in new categories but now it’s going crazy. Founder Hamdi Ulukaya said in the @chobani shareholder letter, “we have significant investments in the past few years to ensure we control our innovation, our production, our distribution, and our marketing.”

13/ @chobani launched dairy coffee creamer in Dec 2019 and now owns 12.8% of a $448M category. In June 2020, Chobani launched Chobani Probiotic and followed that with dairy probiotic yogurts and drinks and Little Chobani Probiotics for kids. In January came ready-to-drink coffee, a $2.3B category growing 18.6% YoY.

14/ @chobani innovation has driven improved financial results. Growth in 2020 was 5.2% YoY, up from 3.2% in 2019. And this year has gotten A LOT better. Growth for the 9 months ended Sept 2021 has been 13.8% YoY.

15/ So how do we value this? Assuming growth in Q4 is the same as the prior 9 months, @chobai will do $1.59 billion this year. Assume the core yogurt business grew 2% YoY since 2018 —> it will do $1.37B in 2020, with new categories at ~$220M.

16/ The core @chobani business is likely valued like the rest of big food, which tightly trades at 2.1-3.1x revenue. Use @generalmills as a comp at 2.8x revenue and growing 4% YoY. This values their core business at $3.8B.

17/ The $220M in @chobani new categories is growing CRAZY fast (Chobani oat milk at +68% YoY). Comps are likely @oatly, at 9x TTM revenue, and @beyondmeat, at 11.5x. @oatly new category growth is faster than either of these. At 10x sales, this piece of @chobani is valued at $2.2B.

18/ Sum of the parts here points to a $6B valuation for @chobani, but we all know @chobani is going to trade a lot higher than that. Why? (1) This is a beacon for every other ESG company and will attract capital commensurately; and (2) value will be put on their innovation platform + distribution capabilities.

19/ The world would be better off with more companies like @chobani. I’ll be cheering for @chobani to take more share from big food in every category in which they launch and operate!

Another excellent write up Jason. Perhaps investors looking for solid returns and a hedge against crypto positions...the new world! The corporate culture of Chobani is inspiring and well ahead of popular ESG mandates.