Birkenstock F-1

Founded before America, Birkenstock could become the next iconic publicly traded brand

1/ After spending decades following its 1970s hippie heydays as a stodgy brand focused on utility and comfort, Birkenstock has come roaring back. Birkenstock recently filed for an IPO on the back of extremely healthy financial results.

2/ The pivotal moment in the brand’s resurgence was in 2013, when the Birkenstock family brought in Oliver Reichert as the first CEO from outside the family. He aligned the brand with emerging fashion trends, integrating style with its foundational comfort. He capitalized on the "ugly fashion" and "normcore" trends, while emphasizing heritage and sustainability.

3/ Reichert says in the IPO filing, “We see ourselves as the oldest start-up on earth. It took a lot of imagination to envision how to turn this sleeping giant into a global super brand.”

4/ Let’s dive into the IPO filing and see if we can assess whether Birkenstock’s resurgence is ephemeral or if they have the foundation in place for a multi-decade growth story.

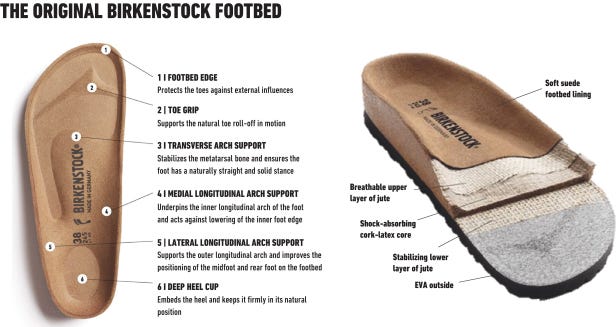

5/ It all starts with product. For Birkenstock, everything begins with their legendary BIRKENSTOCK footbed, which “represents the best alternative to walking barefoot, encouraging proper foot health by evenly distributing weight and reducing pressure points and friction.”

6/ Birkenstock has 700 silhouettes but the top 5 generate 76% of revenue. The strategy is to have a timeless foundation but to augment that with constant newness and nods to high fashion.

7/ Since Reichert took the helm, Birkenstock has counterintuitively initiated high-profile limited edition collaborations with luxury designers like Valentino, Rick Owens and DIOR, elevating its fashion credentials.

8/ The best indicator of brand power is pricing power. An ON Cloud costs $130-$160, similar pricing to Birkenstock’s featured shoes on its website. But the pricing umbrella extends further - a Dior Birkenstock sandal costs $1,100. This is no longer your father’s Birkenstock!

9/ Interestingly, L Catterton, the captive PE firm of LVMH, bought a majority stake in Birkenstock in Feb ’21 for $4.3B. Birkenstock was already using the LVMH playbook for building brand value and now they had the tools to supercharge it.

10/ The final note on product is that unlike Nike, which makes nothing, Birkenstocks is vertically integrated. It sources >90% of its materials from Europe and assembles >95% of products in Germany.

11/ Birkenstock boasts very high customer loyalty. The average Birkenstock customer in the U.S. owns 3.6 pairs today. 90% of recent purchasers indicated a desire to purchase again.

12/ It is difficult to understand whether the Birkenstock customer is spending more or less each year. I wish they would show an analysis of their D2C business in the filing. What is revenue per customer per year, what is cohort revenue retention and customer retention? My gut is the brand is gaining share of wallet but... we are flying in the dark analyzing this business due to a lack of data in the F-1.

13/ Now let’s turn our analysis to channel. Birkenstock has been brilliant in building its D2C channel, which is largely e-commerce. D2C grew from 18% of revenue in 2018 to 30% in 2020 and 38% in 2022. They have done so cleverly, with a member program, which gives early access to limited editions, free shipping and 10% off certain styles. Now they own those customer relationships, which used to sit with wholesalers.

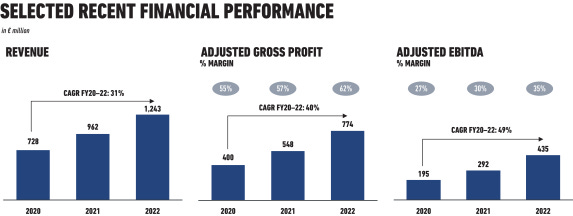

14/ Birkenstock’s innovations in product, brand and business model have led to brilliant financial results, and high margins. Revenue has grown at a >20% CAGR since 2014.

15/ Note that Birkenstock’s gross profit margin of 62% sits above Nike (44%), Adidas (51%), Crocs (54%), and ON (57%). It more resembles luxury brands like Moncler and LVMH (both ~68%).

16/ So how does this business get valued? Given the steady growth since 2014, the centuries of tradition, and its pricing power, I would argue Birkenstock should have comparables in luxury more so than in shoes. A very relevant comp would be LVMH. A more direct comp is ON Running.

17/ Note in the chart above that even though ON is growing >3x faster than LVMH, its trailing 12 month multiple of EV/gross profit is only 51% higher. The reason is simple: Investors assume LVMH will be enduring. That is still a risk for ON. I’d posit Birkenstock sits somewhere closer to LVMH than ON in this regard.

18/ I won’t do a DCF analysis here but EV/gross profit is a good back of envelope proxy for like brands. At current exchange rates, Birkenstock has $794M in real gross profit margin on a trailing 12 month basis. If you use LVMH’s multiple, which feels justified based on Birkenstock’s growth rate and tradition, that gets you to $5.5B in enterprise value.

19/ The rumored IPO value is $8 billion, according to Bloomberg. That is the equivalent of using ON’s EV / gross profit multiple, although ON is growing much faster. Unless Birkenstock accelerates growth significantly, that feels hard to justify.

20/ Regardless of what happens from here, Birkenstock is a classic case study of taking an enduring brand, modernizing it and creating enormous economic value for all of those involved. It was a risk for the Birkenstock family to bring in Riechert as CEO and LVMH as investors. It looks like it will pay off in spades.