1/ TLDR @udemy S-1. A future education giant is building an immensely promising, albeit still sub-scale, enterprise business off the back of a mediocre consumer marketplace. In today’s labor market, employers will increasingly turn to @udemy, @coursera, @skillshare, and @pluralsight to upskill their workforce and provide educational benefits to employees. COVID greatly accelerated this trend.

2/ @udemy began in 2010 as a consumer marketplace business enabling anyone to sell a course in any subject. Today, the marketplace has 183,000 courses and serves more than 44 million users globally.

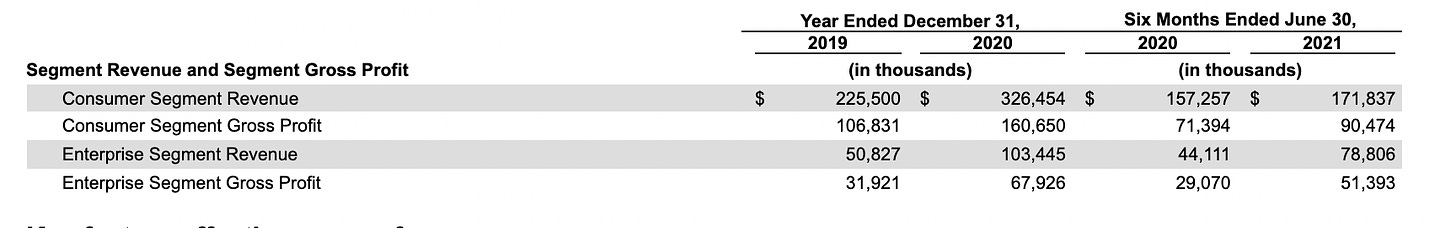

3/ The core @udemy consumer marketplace is a slow growth line of business. After seeing a nice and unsustainable COVID bump, it grew only 9.3% YoY in 1H 2021. It’s hard to make money selling one-off courses at $11.99 for ~53% gross margins.

4/ At the same time, from a macro standpoint, COVID has created two pressing needs for businesses. First is to retain current employees, and we are seeing an explosion of benefits thrown at employees as a result. Second is the need to upskill your employee base given the difficulty of hiring.

5/ And the corporate learning market is huge, pegged by @udemy at $71 billion.

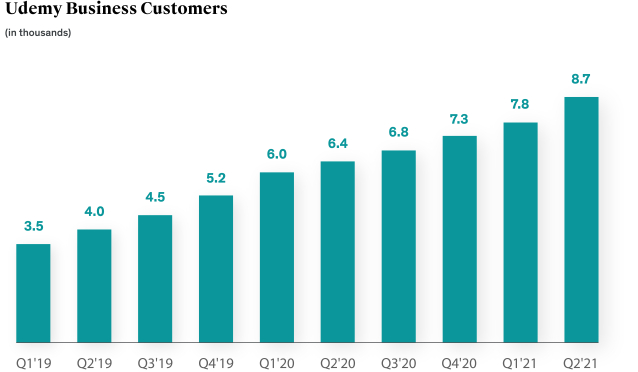

6/ In an elegant act of jujitsu, @udemy leveraged its core consumer assets to build Udemy Business. After launching in 2015 and getting off to a slow start, look at the growth since 2019. This reminds me of what @jakeschwartz did @ga, using the power of a strong-but-hard-to-differentiate consumer brand to build an enterprise business.

7/ The knock on @udemy has always been the uneven quality of its courses. For the business offering, it is able to take its top instructors and tightly curate the best 6,000+ high quality courses from the 183K on the platform. It also prepares users for certifications and offers enterprise-grade administrative tools. List price is $360 per seat, per year.

8/ From a business model standpoint, the consumer business has ~52% gross margins as there is a straight revenue share with instructors. It’s not entirely clear, but my guess is there is more of a Spotify usage type of model with the B2B business, yielding rich 65% gross margins, with upside from here.

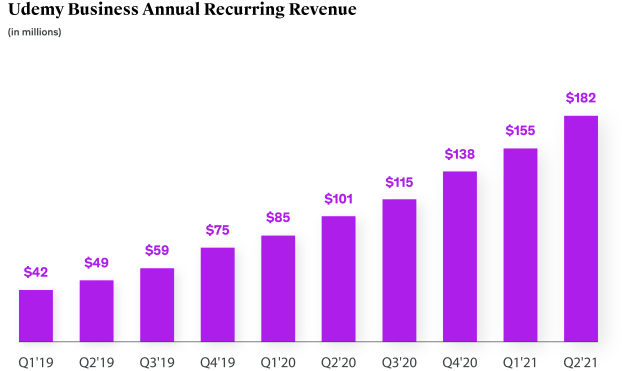

9/ The growth in ARR in Udemy Business is straight up impressive. $182M as of Q2, with 80.1% YoY growth. And customers are growing with @udemy, with net revenue retention at 123% in 1H 2021. I wish we saw more data on (1) customer retention in addition to revenue retention; (2) LTV:CAC and payback period for enterprise customers.

10/ All these positives aside, Udemy Business is still a small share of wallet for customers. @udemy has 42 of the Fortune 100 as customers amongst their 8,600 total customers. Even if the Fortune 100 is 50% of @udemy revenue, that is still only ~$2M per customer. That’s really just a Beta test.

11/ Given how much money companies are throwing against benefits in today’s tight labor market, I am short to medium term very bullish on @udemy. The dollars are falling from the sky and @udemy is there to pick them up.

12/ In the long term, to build a truly iconic brand, @udemy will need to show real results and efficacy for their corporate customers. Can an employee with quant skills learn data science? Can one with creative instincts learn graphic design? And can @udemy teach these skills more effectively than competitors that range from @coursera and @pluralsight to @asuonline, @snhu and @2uInc?

13/ @udemy should be valued as a sum of the parts. The consumer business should do ~$350M this year. Maybe it gets valued like other slow growth consumer businesses like Verizon: so call it ~3x revenue or $1 billion in enterprise value.

14/ The bulk of @udemy value is in Udemy Business. Comparables here include HR SaaS businesses like Paycor (~17x TTM Sales), Ceridian (22x), Workday (15x) or Paycom (34x). Say it is a 20x current ARR, placing Udemy Business at $3.6B in value.

15/ Adding up the consumer and business value gets us to $4.6B, which is slightly ahead of the IPO range of $4B, and it should get there with a small pop. If you just lazily apply Coursera’s 10.8x TTM revenue multiple to @udemy, it’s worth $5.2B.

16/ Last but not least, I want to send a huge congratulations to my Wharton classmate and friend Sarah Blanchard, who is Udemy’s CFO. I’ll be cheering for Udemy and Sarah as they strive to meet what I see as huge upside potential.

excellent pithy analysis again Jason!

Thanks Jason. Enjoying your analysis and agree. MOOC is a challenging market; I happen to bump into this article today after reading yours - https://medium.com/@nanatrgle/3-powerful-competitive-analysis-models-to-develop-actionable-strategy-blue-ocean-strategy-canvas-70a53e2f21f2